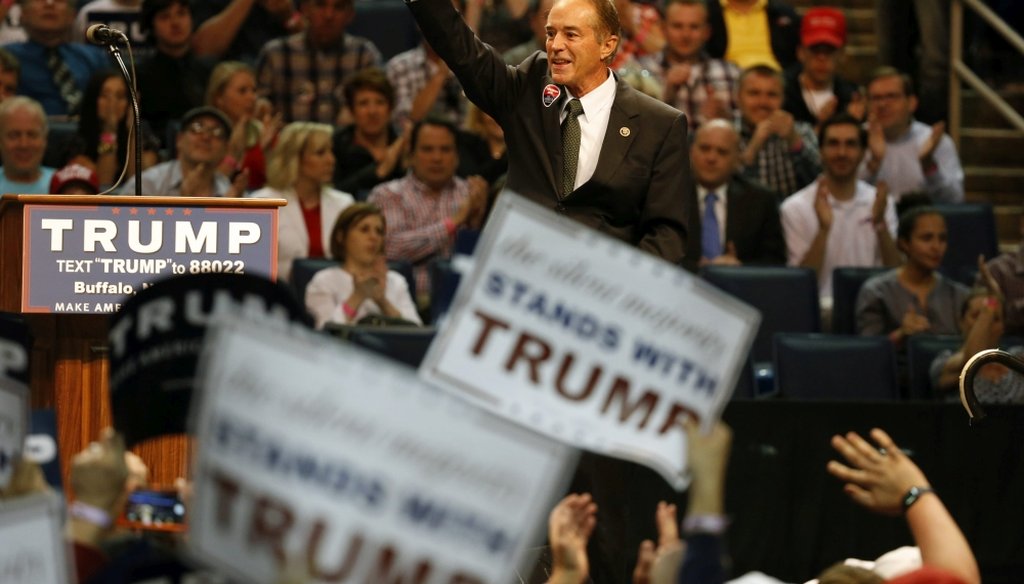

Rep. Chris Collins, R-Clarence, tweeted a few claims about the new Republican tax law. (Harry Scull Jr./Buffalo News)

U.S. Rep. Chris Collins said many Americans are already benefiting from the tax law Republicans in Congress passed in December.

Collins used the claim to attack House Minority Leader Nancy Pelosi in a tweet.

"Because of #TaxReform, 4 million American workers have received raises and bonuses, and 90% of Americans are seeing bigger paychecks this month," Collins tweeted. "Despite what @NancyPelosi may say, this isn’t "crumbs" for hardworking families in #WNY."

Pelosi had previously called the tax benefits for middle- and low-income earners "crumbs" compared to what wealthy earners would receive.

Republicans who support the tax plan disagree. They believe the tax bill provides significant relief for those workers.

Collins, a Republican from suburban Buffalo, says those benefits have already started. Is he right?

‘4 million American workers’

President Donald Trump claimed 3 million workers in the U.S. had already received a pay increase or bonus thanks to the tax bill at the end of January. PolitiFact rated that claim Mostly True.

PolitiFact checked Trump’s claim using data from Americans for Tax Reform, a group that advocates for lower taxes. The group supported the Republican tax bill.

The group has a running list of companies that have announced bonuses or other benefits based on press releases and media reports since the tax law passed. At the end of January, at least 286 companies had announced benefits for more than 3 million workers.

That number has since grown to more than 4 million workers from 408 companies, according to the group. Those workers have gotten a bonus, pay increase, 401(k) hike, or utility rate cut because of the new tax law, according to reports.

That’s not a small number of workers, but it accounts for less than 3 percent of the total employed population in the U.S.

Experts also told PolitiFact that some of the bonuses may have already been planned before the tax law to retain workers in a tight labor market.

Larger paychecks

The second part of Collins’ claim is based on a prediction from the U.S. Department of the Treasury.

The agency said in January that 90 percent of working Americans would have less federal tax withheld from their paychecks by the middle of February. Employers had until Feb. 15 to implement the lower federal tax rates.

"We’re estimating that 90 percent of workers are going to see an increase in take-home pay because of the Tax Cuts [and Jobs] Act," U.S. Treasury Secretary Steven T. Mnuchin said.

We reached out to the agency to see if its prediction panned out for February. We did not hear back.

The actual share of workers with more take-home pay may be lower than 90 percent, according to Howard Gleckman, a senior fellow at the Urban-Brookings Tax Policy Center.

"It is true that roughly 90 percent of Americans will get a tax cut this year as a result of the Tax Cuts and Jobs Act," Gleckman said.

But many Americans will not see higher take-home pay because of other factors, like higher health insurance premiums.

Higher premiums could exceed any increase in take-home pay. Premiums for individual and employer-sponsored health plans are expected to rise again this year. An argument could be made that without the new tax rates, employees would have less money to pay for the higher premiums.

More benefits from the law will be available during next year’s tax filing period. That’s when other provisions begin, like a higher standard deduction for filers.

Our ruling

Collins said "Because of #TaxReform, 4 million American workers have received raises and bonuses, and 90% of Americans are seeing bigger paychecks this month."

The first part of Collins’ claim is correct based on a compilation of companies from a tax cut advocacy group. PolitiFact used the same list when fact-checking Trump on a similar claim.

The second part of Collins’ claim is less clear. The Treasury Department predicted 90 percent of workers would have lower federal taxes in February. We don’t know how many had higher take-home pay, Gleckman said.

The statement is accurate but needed additional information. We rate it Mostly True.

Tweet from Rep. Chris Collins, Feb. 27, 2018

Email conversation with Sarah Minkel, spokesperson for Collins

"Pelosi’s ‘Crumbs’ Comment in Context", FactCheck.org, Feb. 2, 2018

PolitiFact: Donald Trump says tax bill led to bonuses for 3 million workers, Jan. 30, 2018

Americans for Tax Reform: List of companies that have given workers financial benefits

Employed population in the U.S., U.S. Bureau of Labor Statistics

Phone conversation with Howard Gleckman, senior fellow at the Tax Policy Center

"Employer health insurance premiums show a small rise, less than the increase for Obamacare plans," The LA Times, Sept. 19, 2018

"Treasury: 90% of wage earners will likely see higher take-home pay," CNN, Jan. 11, 2018

"Tax bill beginning to deliver bigger paychecks to workers," AP, Feb. 1, 2018

"New Withholding Guidelines Under The Tax Cuts and Jobs Act Will Increase Take Home Pay," U.S. Department of the Treasury, Jan. 11, 2018

"Distributional Analysis of the Conference Agreement for the Tax Cuts and Jobs Act," Tax Policy Center

In a world of wild talk and fake news, help us stand up for the facts.