Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

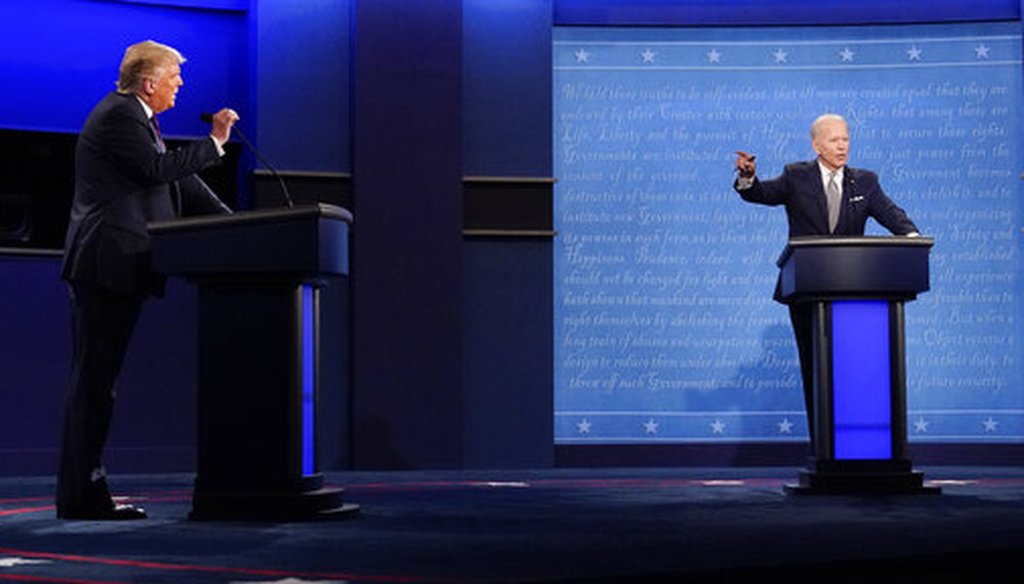

President Donald Trump, left, and Democratic presidential candidate and former Vice President Joe Biden, right, gesture during the first presidential debate on Sept. 29, 2020, at Case Western University and Cleveland Clinic, in Cleveland, Ohio. (AP/Cortez

A 2009 law during the Great Recession expanded taxpayers’ ability to reduce previous years’ tax liabilities by "carrying back" business losses.

Trump has also benefited from a historic preservation tax credit for renovating the Old Post Office in Washington, D.C., into a luxury hotel.

To be clear, there’s no link between the 2009 law and the tax credit for Trump’s Washington hotel.

President Donald Trump disputed the New York Times' report that he paid little to no federal income taxes in many years, claiming in the first presidential debate with former Vice President Joe Biden that he actually paid "millions of dollars" in federal income taxes.

At the same time, Trump also said he tries to reduce what he pays through legal tax maneuvers, and he blamed Biden for the laws that let him do so. "I don’t want to pay tax," Trump said at one point.

"Like every other private person, unless they're stupid, they go through the laws, and that's what it is," Trump said. "(Biden) passed a tax bill that gave us all these privileges for depreciation and for tax credits. We built a building, and we get tax credits like the hotel on Pennsylvania Ave."

Trump’s claim that he paid "millions of dollars" in federal income taxes in 2016 and 2017 is countered by the New York Times, which obtained years of his tax-return data.

But we wondered about the president’s claim about a Biden-passed tax bill. Asked what Trump was referring to, the Trump campaign cited a passage in the Times report, which described how Trump got a $72.9 million tax refund due to a change made under President Barack Obama.

The change was part of a law enacted during the Great Recession. It allowed net operating losses incurred by businesses in 2008 and 2009 to be deducted from tax liability for the previous five years, rather than the prior limit restricting such "carrybacks" to two years. Biden was vice president at the time the provision kicked in.

"Now business owners could request full refunds of taxes paid in the prior four years, and 50 percent of those from the year before that," the Times wrote.

Trump took advantage of this change to wipe out the federal income taxes he paid from 2005 through 2007 with the tax refund, which he claimed and received starting in 2010, according to the Times. The refund is the subject of an audit by the Internal Revenue Service.

What does that have to do with depreciation and tax credits?

Without access to Trump’s tax returns and financial records, it’s difficult to know what "privileges" Trump was talking about. The Trump campaign did not respond when PolitiFact asked if there were other tax bills or privileges linked to Biden that Trump was referencing.

But tax experts said Trump’s mention of the historic preservation tax credit he received for his hotel in Washington appears to jumble the details between the tax refund he got and other tax deductions or credits he may have taken to reduce his tax liability over the years.

"One could view the statement (from Trump) as simply confused and getting the details badly wrong," said Daniel Shaviro, a professor of taxation at New York University School of Law.

Trump’s debate-night claim has to do with the provision passed under Obama that allowed losses from businesses to be used to recoup taxes paid in the previous five years. The provision was part of the Worker, Homeownership and Business Assistance Act of 2009.

"A business can only carryback or carryforward certain amounts, and that bill removed some of those restrictions temporarily for 2008 and 2009," said Joseph Bishop-Henchman, the vice president of tax policy and litigation at the National Taxpayers Union Foundation.

"It’s an efficient, relatively hidden way to help certain rich people," added Edward McCaffery, a professor of law, economics and political science at the University of Southern California, who noted in an op-ed that a similar provision was included in the coronavirus relief bill from March.

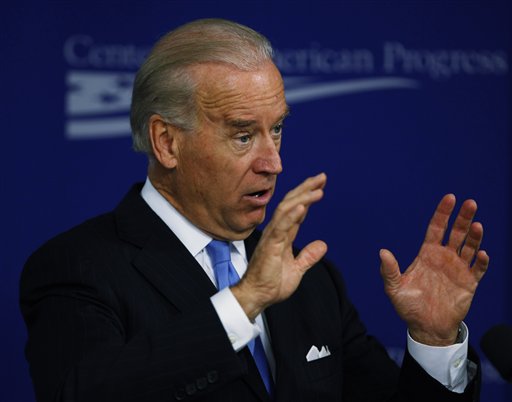

Joe Biden speaks at a panel on the economy in Washington on Nov. 5, 2009, one day before the Worker, Homeownership, and Business Assistance Act of 2009 was signed into law. (AP)

In Trump’s case, the change let him request the tax refund that is now being scrutinized by the IRS and a congressional tax committee. If the IRS decides the refund was illegitimate, the Times reported Trump could owe the government more than $100 million.

The audit dispute over Trump’s tax refund may center, according to the Times, on Trump’s declaration in his 2009 tax return of more than $700 million in business losses. The Times said the materials it obtained did not show which business or businesses created those losses.

The carryback rule would have allowed losses incurred for any reason to be applied to income up to five years in the past, McCaffery said, including losses from depreciation, or the reduction in the value of property or an asset over time.

But it’s unlikely that all Trump’s losses are from depreciation, experts told PolitiFact. The Times reported that Trump’s records show that his casinos, golf courses and other interests lose real money, and that "he has lost chunks of his fortune even before depreciation is figured in."

"We'd have to know precisely where the ‘excess losses’ that he had circa 2009 came from," McCaffery said. "The fact that this is what the IRS is auditing strongly suggests it’s not simply depreciation, which would be based on easily audited facts."

"There’s a lot more to what he’s done than just using depreciation and tax credits," added Steven Rosenthal, a senior fellow at the Urban-Brookings Tax Policy Center.

Other tax maneuvers documented by the Times included questionable write-offs for business expenses and a charitable tax deduction. But the $700 million in losses appears to correspond with Trump’s decision to part ways with his casinos in Atlantic City, N.J., the Times reported.

There’s no obvious connection between the 2009 bill, which doesn’t mention depreciation, and other depreciation deductions or tax credits Trump may have applied. Garrett Watson, a senior policy analyst at the Tax Foundation, said the change to carryback rules was not a tax credit.

Trump’s reference to his hotel in Washington, D.C., further muddles the facts.

The exterior of the Trump International Hotel in Washington on Oct. 26, 2016. (AP)

A 2015 report by Sen. James Lankford, R-Okla., found that the Trump Organization got $40 million in the form of a historic preservation tax credit for renovating the Old Post Office into a hotel, which the Times said he has used to reduce his tax liability in more recent years.

But that type of credit has been on the books since 1976. "This didn’t have to do with any policy change on the part of the Obama administration or Congress," Watson said.

Laws enacted under Obama did create or extend several tax credits. Bishop-Henchman noted that Obama’s economic recovery packages extended provisions allowing businesses to deduct 50% of the cost of certain properties up front, rather than write all costs off over time.

As a U.S. senator representing Delaware, Biden also voted yes on a pair of bipartisan tax laws in 1981 and 1986 that "overhauled the depreciation system," Watson said, while also noting that "depreciation existed in a slightly different form" before 1981.

"We don’t know how those particular changes impacted Trump’s specific tax situation," Watson added. "Depreciation changes in the code are generally changes in timing of when expenses associated with an investment are deducted, so they do not impact total tax paid in the long run."

Regardless, Biden was just one senator.

"It’s always peculiar when Trump is blaming Biden for legislation that happened to be enacted when Biden was in office as a senator or the vice president," Rosenthal said, noting that there are many more people involved with tax legislation.

Trump said Biden "passed a tax bill that gave us all these privileges for depreciation and for tax credits. We built a building, and we get tax credits like the hotel on Pennsylvania Ave."

A 2009 provision enacted under Obama allowed losses to be used to reduce tax liability for up to five previous years. The Times reported that Trump used this provision to claim a major tax refund. At the time, Biden was vice president.

Other depreciation deductions and tax credits that Trump may have applied — including the decades-old tax credit for his hotel in Washington — are not clearly linked to Biden or to the 2009 provision that let Trump claim his refund.

Overall, Trump’s claim is partially accurate. We rate it Half True.

CNBC on YouTube, "President Donald Trump says he paid millions of dollars in federal income taxes in 2016 and 2017," Sept. 29, 2020

National Park Service, "Tax Incentives for Preserving Historic Properties," accessed Sept. 30, 2020

Tax Foundation, "Net Operating Loss Carryback," accessed Sept. 30, 2020

GovTrack, accessed Sept. 30, 2020

The New York Times, "Long-concealed records show Trump’s chronic losses and years of tax avoidance," Sept. 27, 2020

The New York Times, "18 Revelations From a Trove of Trump Tax Records," Sept. 27, 2020

Just Security, "Ten Quick Takeaways from the New York Times’ Bombshell Article on Trump’s Tax Returns," Sept. 28, 2020

Investopedia, "Bonus Depreciation," April 24, 2020

CNN, "The stimulus bill includes a tax break for the 1%," March 28, 2020

Sen. James Lankford, "Federal Fumbles: 100 Ways the Government Dropped the Ball," 2015

The Washingtonian, "Trump’s Old Post Office Hotel Project Received $40 Million Tax Break," Dec. 2, 2015

The White House of President Barack Obama, "FACT SHEET: President Obama Has Signed Eight Small Business Tax Cuts Into Law, Pledges to Sign Eight New Tax Cuts Benefitting Millions of Small Businesses," Sept. 10, 2010

The White House of President Barack Obama, "Fact Sheet: The Worker, Homeownership, and Business Assistance Act of 2009," Nov. 6, 2009

Congress.gov, "H.R.5297 - Small Business Jobs Act of 2010," Sept. 27, 2010

Congress.gov, "H.R.3548 - Worker, Homeownership, and Business Assistance Act of 2009," Nov. 6, 2009

Congress.gov, "H.R.1 - American Recovery and Reinvestment Act of 2009," Feb. 17, 2009

PolitiFact, "Fact-checking the first 2020 presidential debate, Joe Biden vs. Donald Trump," Sept. 29, 2020

PolitiFact, "Barack Obama claims credit for 'at least 16 tax cuts to small businesses.'" July 7, 2011

Email correspondence with the Trump campaign, Sept. 29, 2020

Email interview with Joseph Bishop-Henchman, vice president of tax policy and litigation at the National Taxpayers Union Foundation, Sept. 30, 2020

Email interview with Daniel Shaviro, professor of taxation at New York University Law, Sept. 30, 2020

Email interview with Edward McCaffery, professor of law, economics and political science at the University of Southern California Gould School of Law, Sept. 30, 2020

Email interview with Garrett Watson, senior policy analyst at the Tax Foundation, Sept. 30, 2020

Email interview with Gene Steuerle, co-founder of the Urban-Brookings Tax Policy Center, Sept. 20, 2020

Phone interviews with Steven Rosenthal, senior fellow at the Tax Policy Center, Sept. 29, 2020 and Oct. 1, 2020

In a world of wild talk and fake news, help us stand up for the facts.