Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

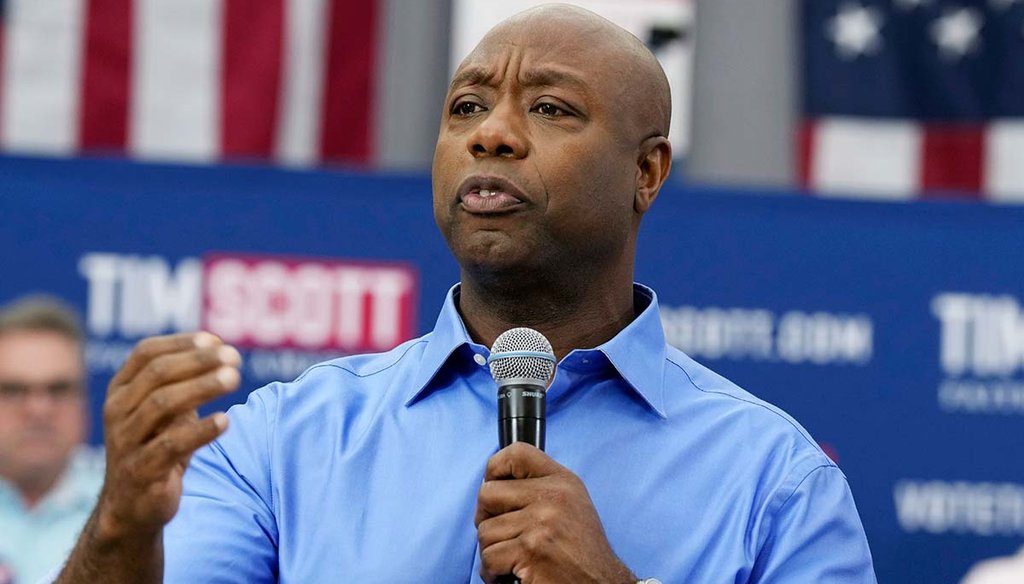

U.S. Sen. Tim Scott, R-S.C., speaks at a town hall, Sunday, April 30, 2023, in Charleston, S.C. (AP)

South Carolina Sen. Tim Scott recently said there has been scant progress for Black homeownership in the past five decades, despite "trillions of dollars spent" on federal housing programs.

"For African American families in particular, the homeownership rate remains relatively unchanged since 1968, the year the Fair Housing Act was signed into law," the Republican said in an April 11 press release from the Senate Committee on Banking, Housing and Urban Affairs.

He added, "Unfortunately, federal housing policy has done little to address the affordability of housing. It’s too expensive and too far out of reach."

Scott, who filed paperwork saying he will seek the 2024 Republican nomination for president, made a similar statement Feb. 9 on his website, and added that the outcome was despite "trillions spent on numerous federal housing programs." In April, he introduced legislation calling for more congressional oversight of federal housing programs; rethinking how agencies collect and analyze data so policymakers can understand what’s working; and encouraging local communities to fix local housing problems.

We looked at statistics from the U.S. Census Bureau and other government agencies and found they show that Scott is spot-on about Black homeownership rates; they have barely budged since 1968. Scott’s spokesperson said the senator reached his conclusion using the same statistics that we did.

On April 11, 1968, President Lyndon B. Johnson signed the Fair Housing Act, which prohibits housing discrimination based on race, color, national origin, sex, family status, religion or disability. The act makes it illegal to offer different terms or conditions for home sales, deny mortgages or refuse to negotiate. It was one in a series of laws that followed the 1964 Civil Rights Act and aimed to end discrimination against Blacks and other minorities.

Two years after the law’s passage, in 1970, the census found that 42% of Black households owned their own homes. In 2022, that number was 44% and had risen 0.4% over 10 years, the National Association of Realtors, a trade group, reported in March.

By comparison, in 2022, white Americans had a 72.7% homeownership rate. The numbers represented the largest Black-white homeownership rate gap in a decade. (Asian Americans and Hispanic Americans also had higher homeownership rates than Blacks, at 62.8% and 50.6%, respectively.)

Census data showed that Black homeownership peaked in 2004 at 49.1%, according to a 2017 PolitiFact report.

Thomas Shapiro, a research professor in Brandeis University’s Heller School for Social Policy, said Scott’s numbers are accurate, but he disagreed with Scott that ineffective government policy is behind the minimal change.

"The Great Recession (of 2008) and housing implosion took a huge bite out of Black (and Hispanic) homeownership," he said. "The more recent homebuyers, especially first-time owners, were hit the hardest, as study after study after study documents."

Minority homeowners, Shapiro added, had more adjustable-rate mortgages, experienced job loss disproportionately and could not keep up with mortgage payments.

Susan Wachter, a financial management and real estate professor at the University of Pennsylvania's Wharton School of Business, agreed with Shapiro. She said that over the past 40 years, home prices have increased faster than wages and the global financial crisis caused many people to lose their homes.

"The minority community was particularly hard-hit," she said. "The anti-discrimination laws I believe have helped, but these barriers remain and are even steeper today than in decades past."

Junia Howell, an assistant professor of sociology at the University of Illinois Chicago, said factors that influence the lack of change in homeownership include Black homeowners deriving fewer benefits from mortgage interest deductions than white homeowners and Black-owned homes tending to be in communities where houses don’t appreciate as much.

Figures from Enterprise Community Partners, a nonprofit dedicated to increasing housing supply, bear that out. The nonprofit said white households receive 71% of mortgage interest deduction benefits.

The liberal Center on Budget and Policy Priorities added that taxpayers with annual incomes exceeding $100,000 receive 80% of mortgage interest benefits — and 16% of Black households earned $100,000 or more in 2020, compared with 33% of whites.

Black homeowners are nearly five times more likely to own a home in a formerly redlined district, which affects home value. "Redlining," a U.S. government practice that ranked homes for their riskiness as investments, was outlawed by the Fair Housing Act. Nonetheless, over the past 40 years, homeowners in formerly redlined neighborhoods have typically gained 52% less in personal wealth generated by property value increases than homeowners in nonmarginalized neighborhoods, Forbes reported.

Scott said, "For African American families in particular, the homeownership rate remains relatively unchanged since 1968, the year the Fair Housing Act was signed into law."

Data shows his numbers are correct. In 1970, about a year and a half after the law was enacted, about 42% of Black Americans owned homes. In 2022, Black homeownership stood at 44%.

We rate this claim True.

PolitiFact Researcher Caryn Baird contributed to this report.

U.S. Census, 1970 data, accessed May 15, 2023

Washington University Journal of Law & Policy, Race, homeownership and wealth, January 2006

National Low Income Housing Coalition, New report shows that the mortgage interest deduction is one of the drivers of the U.S. racial wealth gap, Oct. 17, 2017

PolitiFact, Donald Trump wrong that black homeownership rate is at a record high, Dec. 11, 2017

National Association of Realtors, After 50 years, how much has changed?, September 2018

Northwestern Now, Racial discrimination in mortgage market persistent over last four decades, Jan 23, 2020

Brookings Institution, Even as metropolitan areas diversify, white Americans still live in mostly white neighborhoods, March 23, 2020

Vox, The sordid history of housing discrimination in America, May 5, 2020

Forbes, Redlining’s legacy of inequality: low homeownership rates, less equity for Black households, June 11, 2020

Context, Redlining in America: How a history of housing discrimination endures, July 13, 2020

Social Problems, The increasing effect of neighborhood racial composition on housing values, 1980–2015, Sept. 4, 2020

National Low Income Housing Coalition, Misdirected housing supports: Why the mortgage interest deduction unjustly subsidizes high-income households and expands racial disparities May 2021

The New York Times, What is redlining, Aug. 17, 2021

Enterprise Community Partners, Racial inequities in the mortgage interest deduction, Aug. 25, 2021

Realtor magazine, Program seeks to add 3 million Black homeowners, Feb. 3, 2022

Treasury Department, Racial differences in economic security: housing, Nov. 4, 2022

Sen. Tim Scott, Scott Calls for less failed government spending, more solutions in response to housing challenges, Feb. 9, 2023

Forbes, More Americans own their homes, but the Black-white homeownership rate gap Is the biggest in a decade, survey finds, March 4, 2023

CNBC, Why the homeownership gap between White and Black Americans is larger today than it was over 50 years ago, Aug. 21, 2020

PolitiFact, Ask PolitiFact: Is homeownership harder for Black Americans to achieve? Aug. 31, 2022

The Washington Post. Pandemic led to sharp spike in Black, Asian and Latino homeownership, Nov. 1, 2022

Junia Howell, Color Coded: The Growing Racial Inequality in Home Appraisals, Jan. 24, 2023

Urban Institute, How cities and states can increase Black homeownership, Feb. 22, 2023

National Association of Realtors, More Americans own their homes, but black-white homeownership rate gap is biggest in a decade, NAR report finds, March 2, 2023

Harvard College Joint Center for Housing Studies, Housing Perspectives, March 22, 2023

U.S. Senate Committee on Banking, Housing and Urban Affairs, Scott announces housing framework, April 11, 2023

BPC Action, BPC Action applauds Sen. Tim Scott’s comprehensive housing framework, April 12, 2023

U.S. Committee on Banking, Housing and Urban Affairs, Scott releases discussion draft of housing bill ahead of hearing, April 25, 2023

National Association of Realtors Research Group, 2023 snapshot of race and homebuying in America, accessed May 15, 2023

Email interview, Junia Howell, visiting assistant professor sociology, University of Illinois-Chicago, May 13, 2023

Email interview, Susan Wachter, professor of real estate and finance, co-director, Penn Institute for Urban Research, University of Pennsylvania, May 12, 2023

Email Interview, Thomas Shapiro, professor of law and social policy, Brandeis University, May 15, 2023

Email exchange with Ryann DuRant, communications director, House of Representatives, May 18, 2023

In a world of wild talk and fake news, help us stand up for the facts.