Establish an offshoring tax penalty

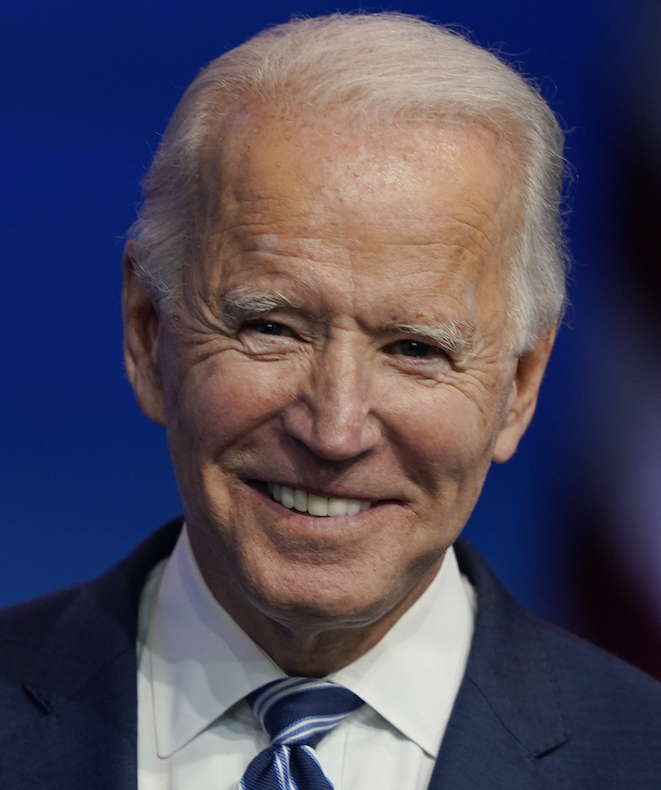

Joe Biden

"Biden is announcing that he will impose a Biden Offshoring Tax Penalty. This penalty is specifically aimed at those who offshore manufacturing and service jobs to foreign nations in order to sell goods or provide services back to the American market. Biden will establish a 28% corporate tax rate, plus a 10% Offshoring Penalty surtax, on profits of any production by a United States company overseas for sales back to the United States. Companies will pay a 30.8% tax rate on any such profits. Biden’s offshoring penalty surtax will also apply to call centers or services by an American company located overseas but serving the United States, where jobs could have been located in the United States."

Biden Promise Tracker

Stalled