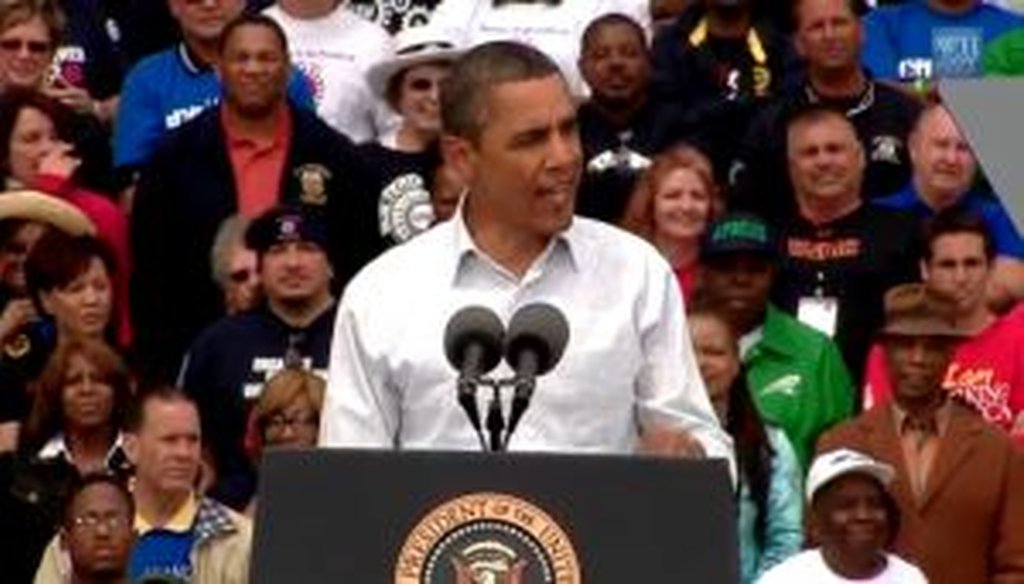

President Barack Obama delivers a Labor Day speech in Detroit. We checked a claim he made about a payroll tax cut he signed into law.

During a Labor Day speech in Detroit, President Barack Obama offered a sampling of policy proposals to get the nation’s economy moving. During the speech, Obama touted one policy achievement he had already enacted -- a one-year, 2 percentage point cut to the payroll tax that Obama was able to include in a December 2010 tax package. The package that passed with bipartisan support also extended the expiring George W. Bush-era tax cuts, among other things.

"Last year, we worked together, Republicans and Democrats, to pass a payroll tax cut," Obama told the crowd in Detroit on Sept. 5, 2011. "And because of that, this year the average family has an extra $1,000 in their pocket…."

Because tax year 2011 is still under way -- meaning that Americans’ personal financial situations will be subject to countless factors between now and Dec. 31 -- it’s impossible to know for sure how much of a benefit the average American family will see when they finally file tax forms next spring. Still, we wondered whether Obama’s figure is supported by credible estimates. So we took a look.

First, some background about the tax, and the tax cut, that Obama is referring to. The payroll tax refers to federal taxes taken directly from the paychecks of employed Americans. It is primarily used to fund Social Security and Medicare.

The policy Obama signed into law temporarily reduced the portion of the payroll tax that funds Social Security by 2 percentage points. It is in force for the duration of 2011.

You can do a rough assessment of Obama’s claim by using some basic math. We prefer to use median income -- the income level that’s precisely in the middle when all incomes are ranked from smallest to largest -- because, unlike the mean (or average), it’s not subject to influence by a small number of very high earners. However, since Obama said "average," we’ll offer both figures.

The median household income in 2009 -- the most recent year available -- was $49,777. Lowering the tax rate by 2 percent reduces the tax burden for the median family by $996, or very close to the $1,000 Obama cited.

As for mean household income, it was $67,976, meaning that the 2 percent payroll tax cut would have left $1,360 extra in the pockets of the average family. By this measure, Obama understated the benefit, though as we noted, an average is a less-than-ideal yardstick.

But there are at least two reasons why using even the median figures is imperfect.

First, not all income is subject to the payroll tax, including interest income, dividends, capital gains, inheritances and Social Security benefits. These income streams are taxed in various ways, but not by the payroll tax, and thus they get no benefit from the payroll tax cut.

Second, not all households include people who are working, and who can therefore benefit from a payroll tax cut. The two most obvious categories are people or couples who are unemployed, and individuals or couples who are retired.

To gauge the impact of these factors, we turned to estimates by the Urban Institute-Brookings Institution Tax Policy Center. The center found that the average benefit from the payroll tax cut was $934 -- slightly lower than Obama claimed. (The median benefit from the tax cut may well be lower still, but the center didn’t calculate it.)

Meanwhile, not all households will benefit. Just under 78 percent of "tax units" -- which roughly equates with households -- will see a reduction in taxes from the payroll tax cut.

So according to the Tax Policy Center, the 78 percent of households who see a benefit will see an average reduction of $934. The remaining 22 percent of households will see no benefit.

These are nuances that Obama didn’t capture in his Labor Day speech.

Our ruling

Obama’s statement is close to correct, but it lacks some clarifications that would have made it fully accurate. First, nearly a quarter of families don’t benefit from the payroll tax cut, although this may be obvious to listeners, since he specifically referred to a "payroll" tax cut. Second, the amount that households saved is at most $934, according to the Tax Policy Center’s calculations -- an amount that would decrease if the center had used a median rather than an average. Obama would have been better off saying that "the average working family has nearly $1,000 extra in their pocket" this year as a result of the payroll tax cut. On balance, we rate Obama’s comment Mostly True.

White House, remarks by President Barack Obama at Labor Day event at a GM plant parking lot in Detroit, Sept. 05, 2011

Urban Institute-Brookings Institution Tax Policy Center, analysis of payroll tax cut for 2011, Dec. 14, 2010

U.S. Census Bureau, "Table H-5: Race and Hispanic Origin of Householder -- Households by Median and Mean Income: 1967 to 2009," accessed Sep. 6, 2011

Text of 2011 tax cut extension bill

Urban Institute-Brookings Institution Tax Policy Center, Tax Topics: Payroll Tax, accessed Sep. 6, 2011

E-mail interview with Bob Williams, senior fellow at the Urban Institute-Brookings Institution Tax Policy Center, Sep. 6, 2011

E-mail interview with Adam W. Abrams, White House spokesman, Sep. 6, 2011

In a world of wild talk and fake news, help us stand up for the facts.